Holding Companies 101: A Guide

Being in the business, the term “holding company” or “HoldCo” very often becomes a topic conversation. But what does this term mean? What are the pros and cons of holding company? Is it right for you and your business? The following guide will shed some light on key concepts and strategic points you might want to consider before making a decision.

The Basics of Holding Companies

A holding company, also known as a Holdco, a holding firm or an investment holding company, is in most cases a non-operating company, meaning that the company does not have active operations such as manufacturing, selling any products or services. The purpose of holding company is to hold controlling shares or membership interests in the other companies to form a corporate group. These other companies (subsidiaries) can be in any industry, where holding companies act as holding pens for subsidiaries but operate independently.

Types of Holding Companies

There are different types of holding companies:

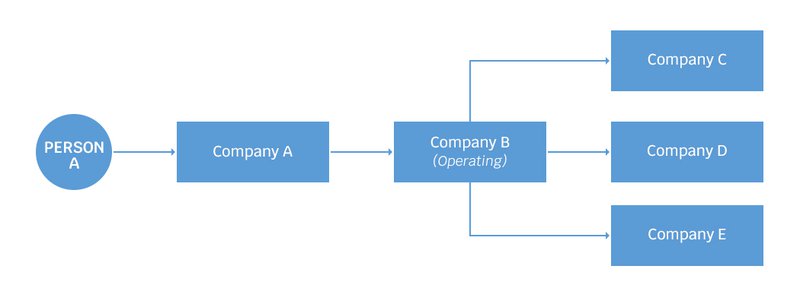

- Holding non-operating company: this is most common holding company type, where the company owns all or most of the shares of another corporation (subsidiary), and such holding company does not have any operations or other revenue streams. In the chart below such company will be “Company A”. Subsidiaries are the companies “B, C, D, E”.

- Holding operating company: holding company that owns all or most shares of another corporation, and at the same time has its own operations in any industry and has one or multiple other revenue streams. In the chart below such company will be “Company B”.

- Subsidiary holding company: holding company that owns all or most shares of another corporation, and at the same time such company is owned by another company. In the chart below such company will be “Company B”.

How Do Holding Companies Work?

There are a few different ways that holding companies can work. The most common way is through the ownership of shares in other companies (subsidiaries). The holding company can own all or most of the shares in another businesses

Read also: Tax return deadlines in canada 2023.

Another way that holding companies can work is through the ownership of assets. The holding company can own all or most of the assets of another company.

The last way holding companies can work is by owning a subsidiary that is also a holding company. This is known as a multi-layer holding company structure.

Advantages and Disadvantages of Holding Companies

Advantages of holding companies include:

Tax planning

One of the main advantages of holding companies is the tax planning on both personal and corporate levels. Operating company can move funds to holding company in the form of dividends (which are tax-free assuming the two companies are associated), which later can be reinvested. The owners of holding company can accurately plan their drawings from the company, which will provide tax savings as personal tax rates are significantly higher than corporate.

Limited liability and asset protection

Holding companies offer limited liability protection to their shareholders. It means that the shareholders are only liable for the amount of money they have invested in the company. Also, holding company that holds assets will protect such assets from creditors if something goes wrong in the subsidiary company.

Lifetime capital gain exemptions

Another great advantage of holding company is that it allows for the purification of the operating company for purposes of lifetime capital gain exemption. If the owner of the company decides to sell the operating company, the life capital exemption can be applied which will decrease tax bill on the sale of business transaction. For example, in 2021 tax year the exemption was $892,218, which means that the first $892,218 worth of capital gains on the transaction would generate no tax for the owner. Certain criteria to be met in order to apply such exemption.

Read also: Toronto vacant home tax – first annual deadline to declare is february 2, 2023.

Ease of operation

Holding companies are relatively easy to operate. A Holdco can centralize your business operations and make it easier to manage your company by having all processes under one roof.

Facilitate Future Expansion

A holding company can provide a framework for future development by allowing you to acquire new businesses or assets.

Disadvantages of holding companies include

Increased costs

There are costs associated with incorporating holding company and maintaining it, meaning ongoing fees for annual compliance, such as, financial statements, corporate tax filings, and other government related filings.

Complex structure

A complex holding company structure can be challenging to understand and manage.

Regulatory restrictions

There are regulatory restrictions on the activities that holding companies can undertake.

FAQ

What business size should have a Holdco?

There are no size restrictions to creating a Holdco within your business structure. However, consideration should be given to include a Holdco when the advantages, discussed above, outweigh the disadvantages. Our team can take a look at your current business structure and advise on the pros and cons specially as it relates to asset protection, tax, and complexity.

How to create a Holding Company?

In Canada, creating a holding company is the same as incorporating any business. First decide whether to register your business on a federal or provincial level. The new Holding company will be issued articles of incorporation, and a unique number or you can reserve a company name with the Trade Register. Registration of the Holdco can be facilitated through online platforms providing incorporation services. Reach out to our team if you require assistance with registering a Holdco.

Holding Company VS Operating Company?

Normally, a Holdco is incorporated to hold assets such as real estate, investments that earn interest, and/or shares of another company. On the other hand, operating companies engage in continuous business providing goods or services.

Can a holding company own real estate in Canada?

Yes, holding companies can own various assets, including real estate. The advantages and disadvantages of holding real estate in a Holdco should be discussed with our team to determine if it is the best path to reach your business goals.

How are Holding companies taxed in Canada?

Similar to other types of corporations, taxable income earned by holding companies are subject to taxation. Dividends paid out by subsidiaries, on the other hand, are exempt from tax. Within six months of the Holding company’s fiscal year-end, annual tax returns must be submitted, and any taxes owed must be paid within two months. Our dedicated tax team can ensure your holding company is compliant and that your tax planning is optimized.

Can a non-Canadian own a holding company in Canada?

A Holdco's shares may be owned by "any person” according to Canadian Law. A "person" can also be a legal entity like a trust, mutual fund, or another corporation in addition to being an individual. Non-residents are able to become shareholders in a Canadian corporation since they meet this definition, however there are significant matters to consider when that is the case as the tax environment for non-residents is substantially different than that of a Canadian resident – our cross-border tax team has all the expertise to navigate you through these issues. Reach out to our team if you are a non-resident of Canada and require assistance with registering a Holdco.